- Chris Kotscha, Century 21 Assurance Realty Ltd, Kelowna, BC.

If you have just entered or are about to enter the Okanagan real estate market hoping to get what was a fair market value just a few months ago, then you will end up making the most common mistake of home sellers and you will end up leaving money on the table.

Chasing The Market in Real Estate

First of all, let's make sure we all understand the phrase "chasing the market."

In all markets, prices are typically moving up or down at any given time. Experts in each market can show you current trends and give you an understanding of why the trend may or may not continue, and how the long-term trend is expected to unfold.

Real estate is no different.

Trends for housing are created by employment, mortgage interest rates, material costs, supply and demand for homes, etc. By studying these factors, I am able to forecast trends for home sellers in the Okanagan real estate market.

When somebody understands a current trend and tries to do something that is not consistent with current market conditions, you might say that he or she is trying to sell a home today, at tomorrow's hopeful value.

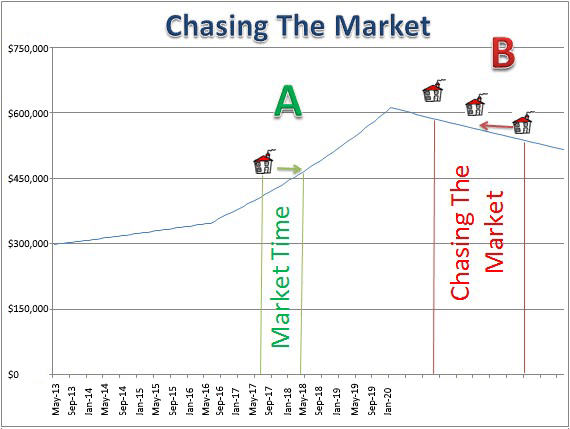

This is how a home seller ends up chasing the market; pre-covid, the market was levelling off a bit. Pricing expectations were fairly in-line with the recent trend. Now, with the dramatic market shift, the same price that was at the ideal point just a month or two ago... are now tomorrow's value, a tomorrow that is no longer coming. The graph below shows this vividly.

You can see in this graph at the final upwards peak, when the Okanagan real estate market was still in an upwards trend but slowing down. Home sellers who were chasing tomorrows market (see "B" in the graph above) were in a chase that would never end. They expected the upwards trend to continue. Now, we are suddenly in Market Cycle B with a decrease. Sellers chased tomorrows prices and have not sold.

They asked a price too high for a period of time, but when they finally reduced their price, it was to no avail. Home values had been falling, so their price reduction was an ineffective step as it simply kept their home priced above the market. Sellers who chased the market from 2018 through 2019 either never sold, or they lost a large amount of potential money as the trend plateaued and then started downwards.

We are no longer in an upwards market. Covid has created a large change. With this sudden shift in demand, an adjustment is bound to happen. So today's market-priced sellers are chasing the market that was, even in February, a fair market value.

These sellers figured "I'm in no hurry" so let's try getting market price (a price that buyers are very hesitant to now pay) and then "we will reduce a little bit, then a bit more until we sell. This is a mistake. As the market drops, the house stays slightly above what buyers are willing to pay. The longer this cycle continues, the more frustrated a seller gets until they do a dramatic price decrease...for thousands less then they could have gotten by getting ahead of the trend earlier.

Why Small Price Reductions Do Not Fetch Top Dollar

There is somebody, right now, who wants to live in your area. We refer to this person as your neighborhood stalker, the person who has seen everything on the market but is waiting for something that better fits his/her needs at the price they are willing to pay, during a time where almost everyone is waiting to see what happens. They want to buy.

Often Sellers try and do small incremental price reductions. Reducing by $5,000 at a time as an example. They reduce, gets a bit more interest so they hold fast. Then, after the initial new interest... no offer comes in. So they wait a bit longer and reduce again. This cycle continues in a way that keeps the sale just out of reach.

The lesson to know; In a downwards market, homes that are sold for top dollar are the ones that sell right away. They do not chase, staying slightly behind. I use the term top dollar. This does not necessarily mean the maximum dollar the property could have gotten, rather the best value that can be achieved in a dropping market. Pricing a home has never been more important than it is today. This stalker knows all about the homes in your neighborhood, and he/she won't be tempted to pay more than it is worth in a month from now.

In the Okanagan a $5,000 or $10,000 price reduction (while it may sound like a lot of money) is a very small percentage. With the average detached home value of $746,000 this is only a 0.6% and 1.3% (respectively) percent reduction. It sounds like a big dollar value, but does not truly change the pricing impression of the home. Think of buying...anything. Would a sign advertising 1.3% off close the deal for you?

Taking this one step further; a $746,000 home with 20% down payment means a mortgage of $596,800. On average rates and terms this translates into monthly payments of approx. $2,685. If the home sold for $736,000 ($588,800 mortgage) instead, that is a payment of $2,649.60. A $35 per month difference in mortgage. So a $10,000 price reduction sounds very large, yet only knocks off $35 per month. It has not changed the impression of the home relative to the market.

In a few months if your property is not sold, most home owners would now accept an offer at 5% below current value, so why not get ahead of that curve? Reduce three percent now and likely sell versus waiting and selling for 5-6% less in time?

The properties where client have been reducing above 3% are the ones receiving offers at this time. Its better to receive offers and say no if they are too low, then to chase and not receive offers. Remember, you, as the Seller are in control as you always have the right to say no to an offer. Let’s get those offers coming in the door!

When you finally do decide to sell your home, give me a call. I'd be happy to discuss the time trade offs in this new market.